Below is our recent interview with Justin Peterson, Senior Vice President of Marketing at Sharestates:

Q: Could you provide our readers with a brief introduction to your company?

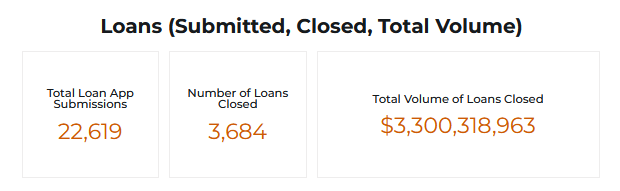

A: Sharestates is one of the fastest-growing national private lenders focused on non-owner-occupied residential and commercial properties. The company creates customized lending solutions for real estate investors and developers. Sharestates has successfully funded over $3 billion in projects nationwide and has the broadest loan programs available in the market with competitive pricing.

Q: Any highlights on your recent announcement?

A: Sharestates appointed a President for the first time since the company was founded in 2013.

Recommended: Meet Norfield Development Partner – A Software & Technology Provider Delivering Damage Preventing Solutions

Q: Can you give us more insights into your offering?

A: Sharestates funds loans from $100k to $20m on residential (SFR 1-4), multi-family, mixed-use, and commercial properties. Its loan programs include residential bridge, fix & flip, new construction, portfolio, and rental loans. Sharestates’ proprietary technology platform allows the Company to more efficiently source and qualifies investment opportunities on real estate projects nationwide and create investment products that are resold to institutional and accredited retail investors.

Q: What can we expect from your company in next 6 months? What are your plans?

A: To continue to gain market share among private real estate lenders as market volatility causes other private lenders to close their doors.

Recommended: Zeus Living Designs And Manages Modern Homes For Rent

Q: What is the best thing about your company that people might not know about?

A: It’s a family business that has grown but stuck to its roots. The Company’s business plan has its roots in a successful relationship-focused regional lending model which is centered around family-focused company culture.