Strabo emerges as a pioneering personal finance dashboard, offering unparalleled customization, global financial integration, and robust security features. It empowers users with forecasting tools and a community-driven approach, enabling effective management of diverse financial portfolios across borders. With its user-centric design and forward-looking roadmap, Strabo is setting new standards in personal finance management.

Introduction: Unveiling the Future of Finance Management

The landscape of personal finance management is evolving, with users seeking more intuitive, comprehensive, and secure platforms. Amidst this backdrop, Strabo emerges as a beacon of innovation, addressing the myriad challenges faced by individuals in managing their finances across borders and currencies. This platform not only promises a seamless experience but also introduces a novel approach inspired by the versatility and customization of Notion, setting a new standard in the domain of financial dashboards.

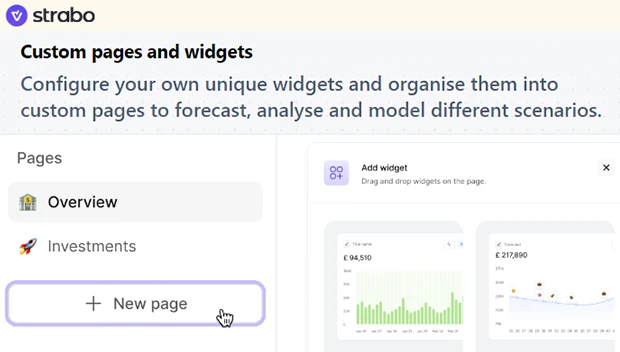

The Notion-Inspired Revolution in Finance Tracking

Strabo takes a leaf out of Notion’s book, emphasizing customization and flexibility. Users can tailor their financial dashboard to their precise needs, thanks to a drag-and-drop interface reminiscent of Notion’s beloved flexibility. This approach allows for a personalized finance tracking experience, where every widget and page serves the unique financial goals and preferences of the user. The ability to configure and reconfigure elements according to changing financial landscapes or personal priorities marks a significant departure from the one-size-fits-all solutions that dominate the market.

Beyond Borders: Strabo’s Global Finance Integration

In today’s globalized world, the ability to manage finances across different countries and currencies is not just a convenience but a necessity for many. Strabo stands out by offering:

- Multi-currency support for seamless management of international accounts.

- Integration with over 10,000 financial institutions worldwide, facilitating a comprehensive view of one’s financial portfolio, regardless of geographic boundaries.

This global finance integration ensures that whether you’re an expatriate, a digital nomad, or an investor with assets in multiple countries, Strabo provides a unified platform to manage your finances with ease.

Security First: How Strabo Protects Your Financial Data

In the digital age, the security of personal and financial data is paramount. Strabo addresses this concern head-on with robust security measures:

- Utilization of Transport Layer Security (TLS) and Advanced Encryption Standard (AES 256) to protect data in transit and at rest.

- A passwordless platform enhanced with Multi-Factor Authentication (MFA), ensuring that access to one’s financial dashboard is both secure and convenient.

These measures underscore Strabo’s commitment to safeguarding user data against unauthorized access, providing peace of mind to users entrusting the platform with their financial information.

Recommended: Toddle Unveils The Future Of No-Code Development Platforms

Forecasting Your Financial Future with Precision

Strabo transcends traditional finance tracking with its forward-looking features. Users can not only monitor their current financial health but also project future growth with tools designed for forecasting net worth and investments. This predictive capability enables users to:

- Visualize the potential growth of their assets based on custom growth rates.

- Plan for significant life events and assess their financial impact.

Such foresight is invaluable for strategic financial planning, allowing users to make informed decisions and adjustments to their financial strategies well in advance.

Empowering Users: The Community and Customization Edge

Strabo distinguishes itself not just through its features but also by fostering a vibrant community of users. This communal aspect is pivotal, as it allows users to:

- Share custom-built templates, enhancing the platform’s utility and personalization.

- Suggest features and improvements, directly influencing the platform’s evolution.

The emphasis on community input ensures that Strabo remains responsive to the needs of its user base, continually adapting and enhancing its offerings. The ability to customize one’s dashboard with widgets and pages tailored to specific financial scenarios or goals further empowers users, making Strabo a genuinely user-centric platform.

Real Users, Real Stories: Success Stories from the Strabo Community

The impact of Strabo is best illustrated through the experiences of its users. From individuals managing diverse international investments to those tracking their journey towards financial independence, Strabo has facilitated a variety of financial success stories:

- Expatriates consolidating their global financial accounts for the first time.

- Investors gaining insights into their portfolio’s performance across different asset classes.

- Families planning for future expenses and savings goals with unprecedented clarity.

These narratives underscore the platform’s versatility and its role in enabling users to achieve their financial objectives, highlighting the tangible benefits of Strabo’s innovative approach to finance management.

Strabo’s Roadmap: What’s Next for the Ultimate Finance Dashboard?

Looking ahead, Strabo’s commitment to innovation and user satisfaction continues to drive its development roadmap. Anticipated updates include:

- Enhanced analytics for deeper insights into investment performance and asset allocation.

- Expanded global coverage, bringing Strabo’s capabilities to more countries and financial institutions.

- Introduction of mobile applications to provide users with on-the-go access to their financial dashboards.

These forthcoming features, informed by user feedback and technological advancements, promise to solidify Strabo’s position as a leader in personal finance management.

Final Thoughts: Charting Your Financial Course with Strabo

Strabo redefines the personal finance dashboard space through its unique blend of customization, global integration, robust security, and community-driven development. By offering a platform that not only tracks but also forecasts financial health, Strabo empowers users to take control of their financial future. As Strabo continues to evolve, it remains dedicated to providing a comprehensive, secure, and user-friendly solution for managing personal finances in our increasingly interconnected world. Whether you’re navigating investments across multiple countries or planning for future financial milestones, Strabo offers the tools and insights needed to chart a course toward financial well-being.

Please email us your feedback and news tips at hello(at)dailycompanynews.com