Exponent Founders Capital, a New York-based venture capital firm, has recently launched a $125 million fund dedicated to investing in early-stage companies across various sectors, including AI, fintech, and enterprise software. Co-founded by Charley Ma and Mahdi Raza, the firm focuses on nurturing startups with the potential to lead their industries. This strategic move aims to impact the tech ecosystem significantly, fostering innovation and growth in the startup community.Top of Form

Introduction: The Dawn of a New Venture Era

In the dynamic realm of venture capital, Exponent Founders Capital emerges as a beacon of innovation and opportunity. With the recent unveiling of its $125 million fund, this New York-based firm sets its sights on revolutionizing the early-stage investment landscape. This strategic move not only signifies a substantial commitment to emerging technologies but also marks a pivotal moment in venture capital, positioning Exponent Founders Capital at the forefront of industry evolution.

Unpacking the $125M Power Move

The $125 million fund, a blend of strategic foresight and market acumen, is earmarked for groundbreaking ventures in their nascent stages. Exponent Founders Capital’s investment spectrum spans a diverse range of sectors, including enterprise software, fintech, infrastructure, applied AI, and vertical SaaS. This fund is not merely a financial endowment but a testament to the firm’s confidence in the transformative potential of early-stage companies across the U.S., Canada, and Europe. The fund’s oversubscription, primarily by nonprofit endowments and hospitals, underscores the market’s trust in Exponent Founders Capital’s vision.

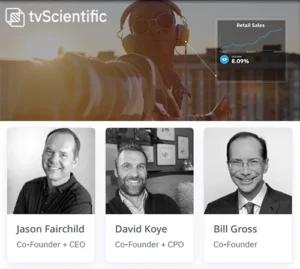

The Visionaries Behind the Venture: Charley Ma and Mahdi Raza

At the helm of Exponent Founders Capital are Charley Ma and Mahdi Raza, whose combined expertise and foresight are the driving forces behind the firm’s strategic direction. Charley Ma, with his rich background in fintech and B2B software, brings invaluable insights from his tenure at companies like Plaid, Ramp, and Alloy. His journey from JPMorgan to leading growth at high-impact firms equips him with a unique perspective on nurturing early-stage ventures. Mahdi Raza, complementing Charley’s expertise, brings a wealth of experience in growth, advising, and investing across various early-stage fintech and enterprise software companies. His transformative work at Robinhood and Stytch, coupled with his investment acumen, positions him as a key player in guiding startups through their growth trajectories.

A Closer Look at Target Sectors: From AI to Fintech

Exponent Founders Capital’s investment focus is strategically aligned with sectors poised for exponential growth. The firm’s interest in enterprise software reflects a recognition of the sector’s pivotal role in modern business operations. Fintech, another key area, is undergoing rapid evolution, driven by technological advancements and changing consumer behaviors. The fund also targets infrastructure and applied AI, sectors that are foundational to the technological advancements of the next decade. Vertical SaaS, with its specialized software solutions, represents another area where Exponent Founders Capital sees significant potential for disruption and growth.

The Impact on the Startup Ecosystem

The launch of Exponent Founders Capital’s $125 million fund is set to create ripples across the startup ecosystem. This infusion of capital and expertise is not just about financial support; it’s about fostering a nurturing environment where innovative ideas can thrive. The fund is expected to catalyze growth in early-stage companies, enabling them to scale new heights in their respective domains. By focusing on companies at the inception and early stages, Exponent Founders Capital is not just investing in businesses; it’s investing in the future of technology and innovation. The firm’s approach, characterized by a blend of financial support and strategic guidance, promises to be a game-changer for startups poised to redefine their industries.

Recommended: Talkbase Events: Transforming The Way We Connect And Engage

Success Stories: Early Wins for Exponent Founders Capital

Exponent Founders Capital’s investment portfolio already showcases a series of triumphs, underscoring its knack for identifying and nurturing high-potential startups. The firm’s early investments include a diverse array of companies, each demonstrating significant growth and innovation in their respective fields. These success stories serve as a testament to Exponent Founders Capital’s strategic investment approach, highlighting its ability to spot and support early-stage ventures that are on track to become industry leaders. The achievements of these portfolio companies not only reflect the firm’s investment acumen but also set a precedent for future investments, reinforcing the firm’s reputation as a catalyst for growth and innovation in the startup ecosystem.

Navigating Challenges: The Road Ahead for Exponent Founders Capital

Despite the optimistic outlook, the path forward for Exponent Founders Capital involves navigating a complex and ever-evolving venture capital landscape. The firm faces the challenge of maintaining its strategic edge in a highly competitive market, where identifying and investing in truly disruptive startups is increasingly challenging. Additionally, the firm must adeptly manage the inherent risks associated with early-stage investing, such as market volatility and the uncertain trajectories of emerging technologies. To address these challenges, Exponent Founders Capital relies on its founders’ deep industry expertise, a robust due diligence process, and a commitment to staying ahead of market trends. This proactive approach positions the firm to not only overcome potential hurdles but also to continue driving impactful investments in the tech sector.

Joining the Innovation Journey: What This Means for Entrepreneurs

For aspiring entrepreneurs, Exponent Founders Capital’s fund represents a beacon of opportunity. The firm’s focus on early-stage companies offers a unique chance for innovative startups to secure the capital and strategic support they need to flourish. Entrepreneurs seeking investment from Exponent Founders Capital should demonstrate a clear vision, a scalable business model, and a commitment to innovation. The firm values founders who exhibit a deep understanding of their market, a capacity for agile adaptation, and a drive to create lasting impact in their industry. By aligning with Exponent Founders Capital, startups not only gain access to funding but also to a wealth of expertise and a network that can accelerate their growth and success.

The Ripple Effect: Broader Implications for the Tech Industry

The establishment of Exponent Founders Capital’s $125 million fund is poised to have far-reaching implications for the broader tech industry. This significant investment in early-stage companies signals a growing recognition of the importance of nurturing innovation at its roots. The fund’s focus on sectors like AI, fintech, and enterprise software is likely to spur advancements in these areas, potentially leading to groundbreaking developments and new industry standards. Furthermore, the success of Exponent Founders Capital’s portfolio companies could inspire a new wave of entrepreneurship, encouraging more innovators to bring their ideas to fruition. The firm’s impact extends beyond its immediate investments, contributing to a vibrant and dynamic tech ecosystem that drives progress and innovation on a global scale.

Beyond the Horizon: Exponent Founders Capital’s Long-Term Vision

Looking to the future, Exponent Founders Capital remains committed to its mission of empowering early-stage companies to redefine their industries. The firm envisions a world where innovative startups have the resources and guidance they need to tackle society’s most pressing challenges. By continuing to invest in and support groundbreaking ventures, Exponent Founders Capital aims to play a pivotal role in shaping the future of technology and business. The firm’s long-term vision is not just about financial returns; it’s about fostering a legacy of innovation, growth, and positive impact that resonates across industries and generations.

In conclusion, Exponent Founders Capital’s launch of a $125 million fund marks a significant milestone in the venture capital arena. With a strategic focus on early-stage companies and a commitment to driving innovation, the firm is well-positioned to make a lasting impact on the startup ecosystem and the broader tech industry. As Exponent Founders Capital continues to invest in and nurture the next generation of industry leaders, its journey will undoubtedly be one to watch in the years to come.

Please email us your feedback and news tips at hello(at)dailycompanynews.com