Cowbell, a cyber insurance provider for SMEs, has announced a significant $25M equity financing round led by Prosperity7 Ventures, highlighting investor confidence and marking a new chapter in cyber insurance. This funding will support Cowbell’s expansion and enhancement of its AI-driven platforms, reinforcing its commitment to adaptive insurance solutions in the face of evolving cyber threats. The investment reflects Cowbell’s rapid growth, including a 2.5x premium growth in 2022 and expansion into the UK market, emphasizing its role in protecting SMEs against digital risks.

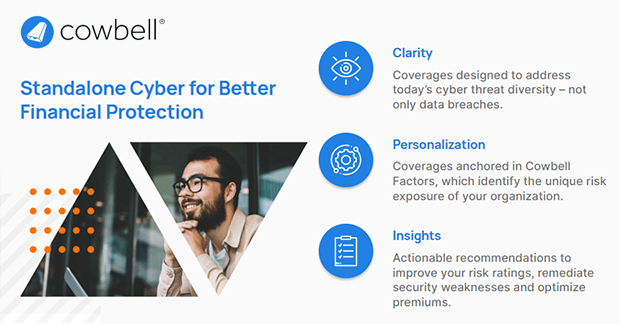

In the ever-evolving landscape of cyber threats, the need for robust insurance solutions has never been more pressing. As businesses grapple with the complexities of digital security, one company stands out in its commitment to safeguarding small- and medium-sized enterprises (SMEs) from cyber risks. Cowbell, a frontrunner in the cyber insurance domain, recently made headlines with its announcement of a whopping $25M equity financing. This move not only underscores Cowbell’s rapid ascent in the industry but also marks a pivotal moment in the broader context of cyber insurance.

The significance of this equity financing goes beyond mere numbers. It’s a testament to the trust and confidence that investors and the market at large have in Cowbell’s vision and capabilities. As we delve deeper into this announcement, we’ll uncover the layers of strategy, innovation, and commitment that Cowbell brings to the table, and why this $25M equity financing is truly a new chapter in cyber insurance.

Background on Cowbell

Founded in 2019, Cowbell has swiftly emerged as a leading provider of cyber insurance tailored specifically for SMEs. With its headquarters nestled in the tech hub of the San Francisco Bay Area, Cowbell’s roots are deeply intertwined with innovation and technology. But what truly sets Cowbell apart is its unique blend of tech-driven solutions with a keen understanding of the challenges faced by SMEs in today’s digital age.

Over the years, Cowbell has championed the cause of “Adaptive Cyber Insurance.” This approach is not just about offering insurance policies; it’s about providing coverage that’s adaptable to the ever-changing cyber threat landscape. By harnessing the power of artificial intelligence, Cowbell’s continuous underwriting platform, powered by Cowbell Factors, has revolutionized the insurance process, compressing it from submission to issue in less than five minutes.

But Cowbell’s journey hasn’t been just about speed and efficiency. It’s been about building trust. With backing from over 20 prominent global (re)insurance partners, Cowbell has expanded its reach to serve SMEs across 50 U.S. states, the District of Columbia, and more recently, the United Kingdom. This expansive growth has been fueled by Cowbell’s dedication to understanding and addressing the unique cyber risks that SMEs face, making it a trusted name in the industry.

Details of the Equity Financing

The recent announcement of Cowbell securing $25M in equity financing has sent ripples throughout the cyber insurance sector. This significant financial boost is not just a testament to Cowbell’s past achievements but a clear indicator of the confidence that investors have in its future trajectory.

Leading the investment round was Prosperity7 Ventures, a name synonymous with backing transformative business models and breakthrough technologies. Their involvement speaks volumes about the potential they see in Cowbell’s approach to cyber insurance. Alongside Prosperity7 Ventures, the financing round also saw participation from other new and existing investors, further solidifying the broad-based support for Cowbell’s mission.

This equity financing builds upon Cowbell’s impressive financial journey. Prior to this, the company had already raised $148M, showcasing its consistent ability to attract investment and drive growth. The funds from this round are expected to be channeled towards expanding Cowbell’s offerings, enhancing its AI-driven platforms, and further solidifying its position as a leader in the SME cyber insurance market.

The Impact on SMEs

Small- and medium-sized enterprises (SMEs) operate in a unique space. While they drive innovation and contribute significantly to the economy, they often lack the extensive resources of larger corporations to defend against cyber threats. This vulnerability makes the role of companies like Cowbell even more crucial.

A recent study shed light on the precarious position of SMEs in the digital realm. A staggering 72% of SMEs without cyber insurance expressed that a major cyberattack could potentially devastate their business. This alarming statistic underscores the insurability gap that exists for SMEs.

Cowbell’s commitment to closing this gap is evident in its rapid growth and expansion. With the recent equity financing, the company is poised to further its mission of safeguarding SMEs against evolving cyber threats. In 2022 alone, Cowbell achieved a 2.5x premium growth, highlighting its proactive approach to addressing the needs of this critical market segment.

Furthermore, Cowbell’s recent foray into the UK market signifies its intent to widen its geographic footprint and cater to SMEs on a global scale. With threats becoming more sophisticated and threat actors increasingly targeting SMEs, the need for comprehensive cyber insurance has never been greater. Cowbell’s dedicated risk engineering and claims management service, Cowbell 365, stands as a beacon of hope for many SMEs. Since its inception, this service has successfully prevented extortion payments in over 74% of cases. And in instances where a ransom had to be paid, the amount was reduced to an average of just 26% of the initial demand.

In essence, Cowbell’s equity financing is not just a financial milestone; it’s a promise. A promise to SMEs that they have a steadfast ally in the battle against cyber threats, ensuring that they can continue to innovate and thrive in a secure digital environment.

Cowbell’s Expansion and Growth

Cowbell’s trajectory in the cyber insurance domain has been nothing short of meteoric. The company’s focus on adaptive cyber insurance solutions tailored for SMEs has resonated deeply within the industry, leading to substantial growth and expansion.

One of the most notable milestones in Cowbell’s expansion journey is its recent launch in the UK market. This move signifies Cowbell’s ambition to cater to a global audience and address the unique challenges faced by SMEs beyond the US borders. The introduction of Prime One for UK SMEs showcases Cowbell’s commitment to offering bespoke solutions tailored to regional needs.

At the heart of Cowbell’s growth strategy is its vertically integrated technology platform. By leveraging AI-based approaches, Cowbell offers a continuously monitored risk pool, which now encompasses an impressive 38 million businesses across the US and UK. This data-driven approach not only enhances the accuracy of risk assessment but also provides real-time insights, setting Cowbell apart from its competitors.

Furthermore, the increasing threat landscape targeting SMEs has underscored the importance of robust cyber insurance policies. Cowbell’s dedicated risk engineering and claims management service, Cowbell 365, has been instrumental in addressing these challenges, offering proactive solutions and ensuring businesses remain protected against evolving cyber threats.

Industry Reactions and Future Implications

The announcement of Cowbell’s $25M equity financing has garnered significant attention from industry stalwarts and experts. Chris Zhong, Investment Principal at Prosperity7 Ventures, emphasized the economic implications of cybercrime, projecting that its costs could reach $24T by 2027. He lauded Cowbell’s strengths, particularly highlighting its people, culture, and unit economics. Prosperity7’s excitement to partner with Cowbell underscores the company’s potential in leading the cyber insurance domain, especially within the SME market.

Jack Kudale, Founder and CEO of Cowbell, reflected on the company’s strong momentum and policyholder growth. He emphasized the importance of the recent investment in deepening Cowbell’s focus on serving markets in the US and UK, attributing the company’s success to its expertise, culture, and market leadership.

Industry accolades have further validated Cowbell’s approach. Cowbell Specialty Insurance Company (CSIC), a wholly-owned subsidiary of Cowbell, earned a Financial Stability Rating® (FSR) of A, Exceptional, from Demotech, Inc. Furthermore, CBInsights recognized Cowbell as one of the top 100 private fintech companies globally, distinguishing it as the only Cyber Insurance provider on its annual Fintech 100 list.

The future implications of Cowbell’s growth and industry recognition are profound. As cyber threats become more sophisticated, the need for adaptive and responsive insurance solutions will only intensify. With its recent equity financing and industry accolades, Cowbell is poised to lead the charge, ensuring SMEs globally have the protection they need in an increasingly digital world.

In the dynamic world of cyber insurance, Cowbell’s recent announcement of $25M in equity financing is not just a financial milestone but a beacon of hope for SMEs globally. As cyber threats continue to evolve, the need for innovative, adaptive, and robust insurance solutions becomes paramount. Cowbell, with its unique blend of technology and industry expertise, is at the forefront of this revolution. The company’s commitment to closing the insurability gap, coupled with its rapid expansion and industry accolades, positions it as a leader in the cyber insurance domain. As we look to the future, one thing is clear: Cowbell’s journey is just beginning, and its impact on the world of SMEs and cyber insurance is set to be transformative.

Please email us your feedback and news tips at hello(at)dailycompanynews.com