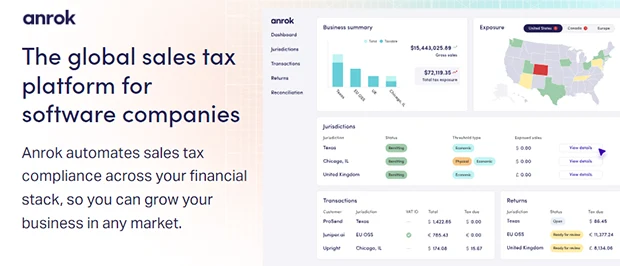

Anrok recently secured $30 million in Series B funding led by Khosla Ventures, with contributions from Sequoia Capital and Index Ventures, reinforcing its commitment to simplifying global tax compliance for digital and SaaS companies. The investment will enhance Anrok’s R&D, enabling it to expand features and support for VAT and GST compliance worldwide. Endorsed by leading tech companies, Anrok’s automated platform is set to shape the future of tax compliance in the digital economy.

Anrok’s Strategic Funding Boosts Global Tax Compliance Efforts

Anrok, a leading global sales tax platform for software companies, recently announced a significant milestone, securing $30 million in Series B funding. This financial infusion, led by Khosla Ventures and supported by other high-profile investors such as Sequoia Capital and Index Ventures, underscores the critical role Anrok plays in modernizing tax compliance for the digital economy.

The Growing Need for Automated Tax Solutions

The digitalization of global markets has brought about an increased complexity in tax regulation, particularly for Software as a Service (SaaS) and digital products. Each country’s unique and often changing tax laws pose a considerable challenge for businesses operating across borders. As a result, there is a heightened demand for automated solutions that can navigate this complex landscape efficiently and accurately, ensuring compliance and mitigating risks associated with non-compliance.

Details of the Series B Funding

Khosla Ventures spearheaded the recent funding round, with significant contributions from Sequoia Capital, Index Ventures, and notable industry leaders including Karen Peacock, former CEO of Intercom; David Faugno, former CFO of Qualtrics and current president of 1Password; and Alex Estevez, former CFO of Atlassian. This investment not only validates the existing achievements of Anrok but also serves as a testament to the trust and confidence these seasoned investors have in Anrok’s potential to scale and innovate further.

Anrok’s Tax Compliance Platform: Features and Innovations

Anrok’s platform offers a comprehensive suite of services designed to tackle the intricacies of global sales tax compliance. Key features of the platform include:

- Real-Time Tax Calculation: Ensures accurate tax rates are applied to transactions based on up-to-date compliance rules across multiple jurisdictions.

- Automated Filing and Remittance: Simplifies the tax filing process by automating submissions and payments to tax authorities, reducing manual errors and administrative burden.

- Global Coverage: Supports VAT and GST compliance for international transactions, crucial for businesses selling digital products and services worldwide.

In addition to these core functionalities, Anrok continuously enhances its platform with advanced tools like a reconciliation feature, robust tax exemption certificate management, and expanded support for a broader range of digital services. This proactive approach not only meets the current needs of its users but also anticipates future regulatory changes that could impact global sales tax processes.

Recommended: Unlocking The Full Potential Of APIs With Zuplo’s Monetization Platform

Impact of the Investment on Anrok’s Operations

The $30 million raised in this Series B round will fuel Anrok’s expansion and product enhancement efforts. Plans include advancing the research and development of new features that cater to the evolving needs of global businesses. This investment will also enable Anrok to strengthen its customer support and service capabilities, ensuring that clients receive the guidance they need to navigate the complexities of tax compliance effectively. By bolstering its infrastructure, Anrok aims to maintain its commitment to delivering a seamless and robust solution that scales with the growth of its customers.

Industry Reception and Customer Insights

Anrok’s solutions are well-received within the technology and financial sectors, endorsed by some of the industry’s most innovative companies. Customers like Notion, Vanta, and Anthropic rely on Anrok for their tax compliance needs, safeguarding their revenues and simplifying complex tax obligations. Testimonials from these users highlight the platform’s impact:

- Temi Vasco, Controller at Gem: “Anrok’s platform simplified our path to compliance and significantly mitigated risk.”

- David Eckstein, CFO: “Anrok has given us better control over our global tax compliance, saving us countless hours each month.”

These endorsements not only demonstrate Anrok’s effectiveness but also its essential role in the financial operations of rapidly scaling businesses.

Looking Ahead: Anrok’s Future Plans and Industry Trends

As digital economies continue to grow and evolve, so too does the landscape of tax compliance. Anrok is well-positioned to anticipate and respond to these changes with its scalable solutions. Future plans include further globalization of its services to support more countries and integrating artificial intelligence to enhance real-time decision-making and compliance predictions. These advancements will ensure that Anrok remains at the forefront of tax compliance technology, offering solutions that are as dynamic as the markets they serve.

Summing Up: The Future of Tax Compliance Is Digital

In summary, Anrok’s recent funding underscores its pivotal role in shaping the future of tax compliance for the digital economy. With substantial financial backing and a clear vision for the future, Anrok is set to continue its trajectory of growth and innovation. The company not only supports businesses in maintaining compliance but also acts as a catalyst for their expansion in the global marketplace. As tax laws continue to evolve, Anrok’s commitment to simplifying the complex will undoubtedly make it an indispensable partner for modern finance teams worldwide.

Please email us your feedback and news tips at hello(at)dailycompanynews.com