ModernFi’s recent $18.7 million Series A funding marks a significant advancement in banking technology, particularly for community and regional banks. This investment, led by major players like Canapi Ventures and Andreessen Horowitz, underscores the platform’s innovative approach to deposit management and growth. ModernFi’s tech-forward solutions are set to revolutionize the banking sector, enhancing competitiveness and efficiency for smaller banks in a rapidly evolving financial landscape.

The Game-Changer in Banking: ModernFi’s Impressive Series A Funding

ModernFi, a rising star in the fintech sector, recently announced a significant milestone: securing $18.7 million in Series A funding. This event marks a pivotal moment for the company, known for its innovative approach to banking technology. The funding round, led by prominent investors, positions ModernFi at the forefront of transforming deposit growth strategies for community and regional banks.

Unpacking ModernFi’s Mission: A New Dawn for Community Banks

Founded in 2022 by Paolo Bertolotti and Adam DeVita, ModernFi emerged from a shared vision to strengthen the backbone of the American economy – community and regional banks. These institutions, often overshadowed by banking giants, face unique challenges in a rapidly evolving financial landscape. ModernFi’s mission is to equip these banks with advanced tools for managing and growing their deposits, thereby enhancing their competitive edge.

The Power Players: Who’s Fueling ModernFi’s Growth?

The Series A funding round saw participation from a consortium of influential investors, including Canapi Ventures, Andreessen Horowitz, Remarkable Ventures, and leading banks like Huntington National Bank, First Horizon, and Regions. These investors bring more than just capital; they offer deep insights and a broad network in the financial sector. Their backing is a testament to ModernFi’s potential to revolutionize banking practices.

Revolutionizing Deposit Management: How ModernFi Stands Out

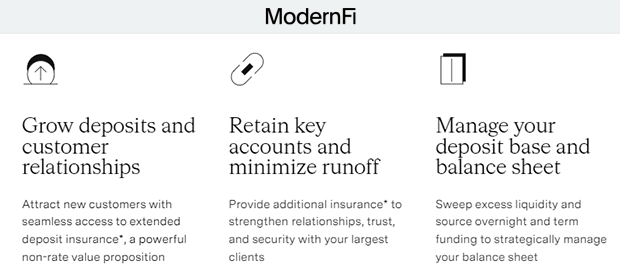

At the heart of ModernFi’s platform is a commitment to leveraging technology for deposit growth and management. Unlike traditional banking systems, ModernFi’s solutions are designed with an API-first, cloud-native approach. This innovative framework enables banks to streamline operations, attract high-value depositors, and offer enhanced security through extended insurance. By simplifying onboarding processes and improving the usability of sweep and reciprocal products, ModernFi addresses critical needs in the banking sector.

Recommended: Business Strategies For A Sustainable Future Lessons From Bruce Piasecki

Beyond the Funding: ModernFi’s Impact on the Banking Ecosystem

ModernFi’s infusion of capital extends beyond mere financial growth; it signifies a transformative shift in the banking ecosystem. The company’s tech-forward approach is set to redefine how community and regional banks manage and grow their deposits. This shift comes at a critical time when banks are grappling with higher interest rates and a competitive landscape that favors larger institutions. ModernFi’s platform provides these banks with a much-needed tool to not only survive but thrive by attracting and retaining clients who might otherwise gravitate towards larger banks or alternative financial services.

Real Voices, Real Impact: What Industry Leaders Are Saying

The industry’s response to ModernFi’s rise has been overwhelmingly positive. Paolo Bertolotti, CEO and Co-founder of ModernFi, emphasizes the importance of modern tools for banks to manage and grow their funding in the face of changing deposit behaviors. Neil Underwood, Co-Founder and General Partner at Canapi, highlights the need for a next-generation solution for reciprocal deposits, praising ModernFi for its timely and innovative approach. These endorsements from industry leaders underscore the platform’s potential to make a significant impact in the banking sector.

Navigating the Future: What’s Next for ModernFi and Banking?

With its recent funding, ModernFi is poised to accelerate its growth and expand its influence in the banking sector. The company’s focus on a tech-enabled deposit network sets it apart in an industry ripe for digital transformation. As banks continue to navigate the challenges of a rapidly evolving financial landscape, ModernFi’s role becomes increasingly vital. The platform’s ability to adapt to the changing needs of banks and their customers suggests a bright future for ModernFi and the banking industry as a whole.

Wrapping Up: The Start of a Banking Revolution

In conclusion, ModernFi’s successful Series A funding round is more than just a financial milestone; it marks the beginning of a banking revolution. By empowering community and regional banks with cutting-edge technology, ModernFi is not only enhancing deposit growth but also reshaping the future of banking. As the company continues to grow and evolve, its impact on the industry will likely be profound and far-reaching, heralding a new era of innovation and growth for banks of all sizes.

Please email us your feedback and news tips at hello(at)dailycompanynews.com