Below is our recent interview with Zainab Daham, PR Manager of CARMA.

Q: What is CARMA? Briefly describe how it works?

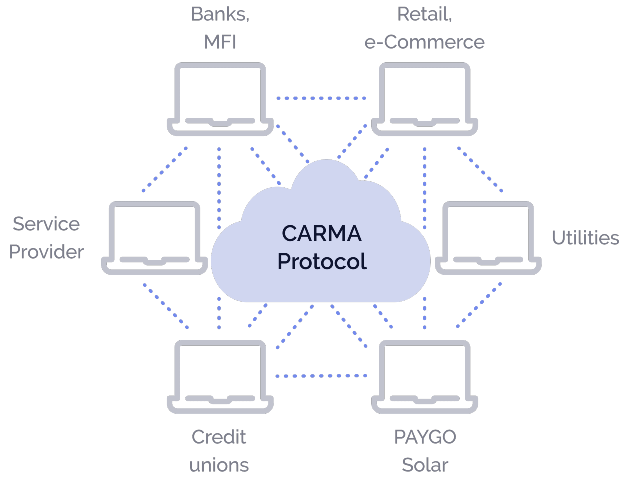

A: Let’s say, CARMA is a type of API that enables the exchange of data between enterprises. It is a peer-to-peer data marketplace that provides organizations to share their data in turn allowing other companies to get access to real-time information.

CARMA allows lenders to source additional data for credit assessment and simply drive any business decisions as it is based on real data. Data contributors get paid for sharing data and they have ultimate control on data management.

Usually, we put together existing APIs and build a direct connection to alternative data holders. Alternative data has the highest priority as often as it concludes only

the digital footprint of the unbanked. We call CARMA the internet for enterprises from time to time.

Q: How private and secure is your users’ information?

A: We allow sharing different layers of information by privacy because information goes literally peer-to-peer between enterprises. We do know what type of data is in a transaction but do not see it as meaning hence the privacy requirements are mostly on the side of organizations and the participants of the transaction.

We manage access to the information by a valid regulation and conditions set by data contributors. For instance, Nigeria approved the Regulatory Framework for Open Banking which explicitly allows consumption of personal and financial transaction information only by Central Bank licensed institutions. This is covered by our onboarding process which distributes rights to access to certain types of data.

We provide pseudonymized subsets for business decisions. It is a great case of how the value of data can be leveraged along with fulfilling the ultimate data privacy.

Security is the most important part. A decentralized way of data transmission mitigates a lot of risks but beyond that, we are fully compliant with the highest standards of data security implemented in open banking frameworks across the globe. We designed a unique encryption way that allows decrypting information only by a valid requester. Even CARMA cannot decrypt it in the middle.

Q: You’ve recently raised an undisclosed amount in Seed funding; can you tell us something more?

A: We were glad to be backed by Microtraction VC for pre-seed funds. They do a great job in building up tech an ecosystem across Africa. They are more than everybody else aware of how big is the issue of getting access to information and the capability to use a single protocol for data transmission between enterprises for making life better for regular Nigerian, Kenyan, Zambian…

Especially, after-COVID time the problem of overindebtedness is common for the bottom-of-pyramid population. Lenders need actual data of each other and even more to do the right risk predictions and that is where CARMA gives them a hand. Smarter funds disbursement will affect the everyday life of every person on the continent and I am not afraid to say this is a part of our mission.

We finalize building initial traction and happy to announce the next fundraiser which is going to help us to expand the solution deeper in Nigeria and kick-off go-to-market actions in a couple more countries.

Q: What can we expect from CARMA in the next six months?

A: The next six months are extremely important for us. We are going to invest a lot into the scalability of our solution on technology and distribution levels. We aim to proceed millions of transactions a month in Nigeria and look forward to international expansion. We encourage local African tech entrepreneurs to be our partners in their native countries. Data decentralization allows us to introduce CARMA in any place in the world in weeks.